When the world’s largest EV maker decides to step out from behind the curtains and grab the tech spotlight, you know something big is about to happen. BYD, a heavyweight in both automobiles and electronics, is shaking up the industry by directly challenging none other than Apple with its own tablet designed for seamless car integration. Move over, fruit—here comes the dragon.

BYD: A Dual-Industry Goliath Emerges

In the Chinese automotive market, the integration of consumer electronics into vehicles has turned into a billion-dollar game—and everyone wants to play. Brands such as Xiaomi and Huawei are already leveraging their years of smartphone and tablet expertise to gain an edge in the car business. Electric vehicle makers like Nio are also launching their own custom devices, like branded smartphones, to secure customer loyalty over the long haul. Now, BYD is joining the fray, but with a unique twist: while its rivals doubled down on consumer tech before jumping into cars, BYD has deep roots in both worlds.

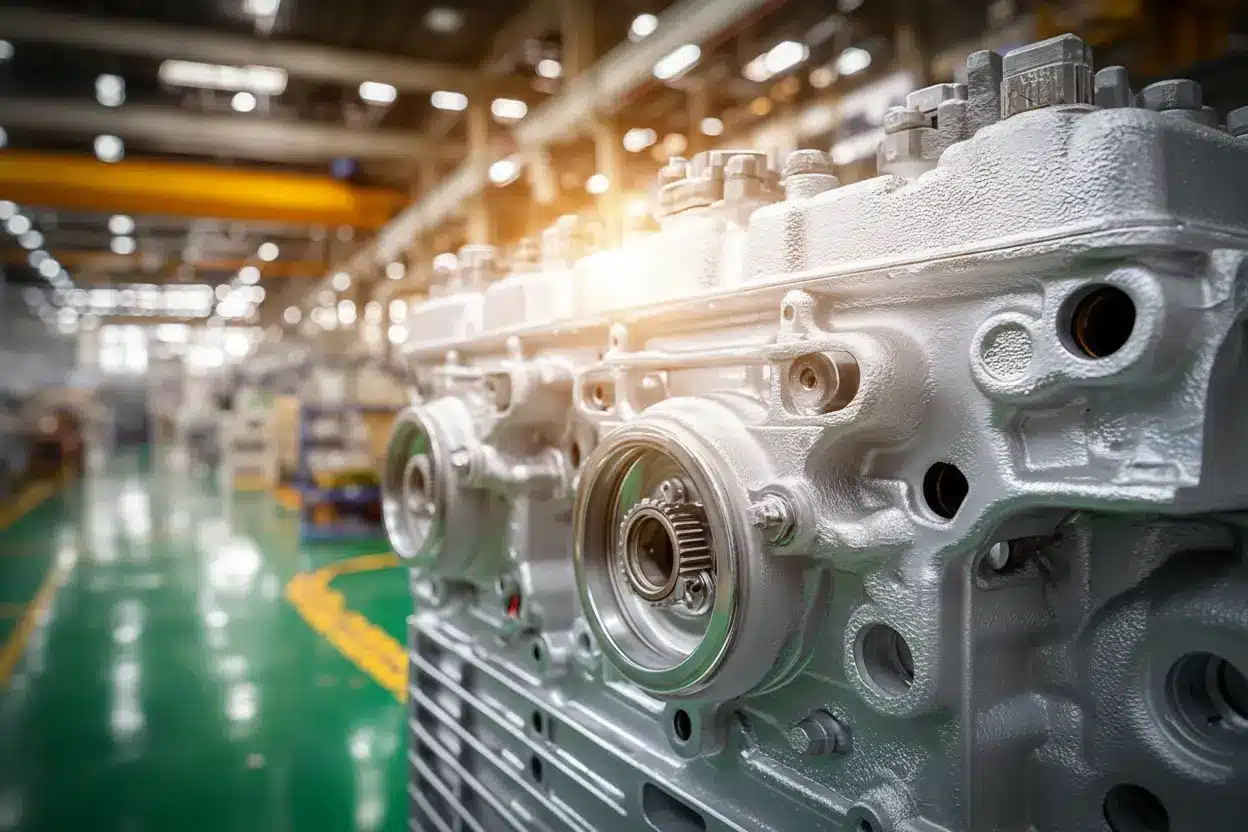

Not only is BYD ranked among China’s largest producers of EVs and batteries, but it also carries heavyweight status in contract manufacturing for consumer electronics. For about 15 years, this powerhouse has held a crucial role in Apple’s supply chain. According to the Wall Street Journal, a staggering one-third of all iPads are now assembled by a BYD subsidiary—no small feat given that this operation employs over 100,000 workers and 10,000 engineers.

While BYD isn’t directly involved in iPhone production, it still provides essential components, such as titanium frames for Pro models. Recently, BYD even acquired two Chinese plants from the supplier Jabil Circuit, which itself is tightly woven into Apple’s production tapestry.

The Birth of the BYD Tablet: A Strategic Leap

Bringing its own tablet to market is far from a vanity project for BYD. It’s a strategic move to tighten control over its value chain. By developing and producing more components and technologies in-house, the company reduces its reliance on external suppliers—a double win for both its core car business and the booming smart electronics sector. After all, why share the pie when you can bake the whole thing yourself?

The launch timing is no accident either. The Tai 7 is aimed at customers in major Chinese cities and is set to hit the market in the fourth quarter of 2025. Meanwhile, in Europe, Fang Cheng Bao models will be sold under the Denza name. The BYD tablet is a fully homegrown development and can communicate seamlessly with the vehicle’s operating system. Translation for the uninitiated? Functions and content can be synchronized between the car’s display and the mobile device without a hitch—a concept spreading across China like wildfire.

Why Tablets—and Why Now?

The logic of betting on tablets is straightforward: the market for connected vehicle displays and mobile devices is booming. Cockpits are rapidly becoming digital playgrounds, and consumers increasingly expect their cars to be as integrated as their smartphones or laptops. Gone are the days when a cup holder felt like a futuristic touch.

Bloomberg Intelligence estimates that by 2030, the global smart vehicle market could rake in $742 billion annually for the auto industry. This explosion of digital opportunity benefits not only automakers like BYD, Volkswagen, Ford, and Mercedes-Benz, but also their suppliers.

- Bespoke tablets mean less dependence on third-party technology.

- Seamless integration offers a sticky, device-ecosystem experience for customers.

- Control of more production stages enhances brand reliability and innovation agility.

More Than Tesla or Apple: A New Digital Mobility Contender

By launching its first self-developed tablet, BYD is making a clear statement: it’s not just out to compete with Tesla in electric drivetrains, but also with the likes of Apple in the domain of digital mobility. The future BYD envisions is one where the boundary between car and device blurs—a prospect that’s growing ever more popular in China, and one likely to catch on globally.

So, what should tech fans and car buyers take away from BYD’s big play? Watch this space, because when a giant that’s long been making others’ gadgets finally puts its own name on the product, the result might just redefine the entire race. And if you thought your next car would just get you from A to B, you might want to look again—it might be the centerpiece of your digital life.

John is a curious mind who loves to write about diverse topics. Passionate about sharing his thoughts and perspectives, he enjoys sparking conversations and encouraging discovery. For him, every subject is an invitation to discuss and learn.